World Nomads is a nomad insurance with generous coverage of up to $5 million (or unlimited) medical insurance.

It is especially recommended for those who include the United States (USA) as their destination. Explorer Plan.

Features of World Nomads

- Insurance rates vary by destination

(e.g., $265.07 per month for a 4-week policy period, including the U.S.) - The maximum amount of medical coverage is $ 5 million

* Explorer Plan is unlimited - Flight delay and lost baggage compensation are available

- 24-hour support (phone/email)

- Easy to file an insurance claim online

This page provides a detailed explanation of the insurance coverage for each World Nomads insurance plan. If you are planning to go to the U.S., please refer to this article.

What is World Nomads?

World Nomads is a global insurer based in Australia. We offer substantial coverage to travelers and nomad workers around the world.

If your destination includes the United States, you may incur medical expenses not covered by credit card insurance, so purchasing a fully covered insurance policy such as World Nomads is highly recommended.

In an emergency, take out insurance before traveling to the United States.

*You can join World Nomads from overseas.

World Nomads Pricing Plans

There are two World Nomads pricing plans: the Standard Plan and the Explorer Plan. Each plan has different prices and coverage.

In addition, the price varies depending on the country you are traveling to, especially if you include the United States. Please refer to the table below.

| Standard | Explore | |

| This does not include the U.S. (if Thailand is specified) | $220.43 | $253.46 |

| Including the U.S | $265.07 | $297.99 |

* The above fee is for the insurance period of 1 month (4 weeks).

* For reference, the price if you select Thailand as your travel destination is listed in the table.

Even if you choose a country other than Thailand, the monthly premium is about $5~$10 cheaper than the above amount.

If you’d like to find out how much your destination will cost, you can easily get a quote on the World Nomads website. Be sure to check it out.

World Nomads Coverage

Please refer to the following summary of the main coverage contents of the “Standard Plan” and “Explorer Plan”.

| Coverage | Standard Plan | Explorer Plan |

| Medical Insurance | $500 | Unlimitedness |

| Medical Transportation and Repatriation | $500,000 | |

| Compensation for your companion | $5,000 | |

| physiotherapy | $250 | $2,000 |

| Counseling | $250 | |

| Compensation for out-of-pocket expenses at the hospital (if you are hospitalized for more than 24 hours) | $2,000 | $3,000 |

| Emergency Dental Care | $300 | $500 |

| Cancellation before travel | $5,000 | $10,000 |

| Interruption of travel (emergency return) | $3,500 | $500 |

| Resumption of travel after returning home | $1,500 | $3,000 |

| Transportation delays (delays of 12 hours or more) | ・Meals and drinks: $150 ・Accommodation and transportation: $500 | ・Meals and drinks: $300 ・Accommodation and transportation: $1,000 |

| Missed flight connection | without | Accommodation and transportation: $1,000 |

| Natural disaster | Accommodation and transportation: $1,750 | |

| Encountering hijacking damage | without | $3,000 |

| Theft, damage or loss of baggage (including lost baggage) | $2,500 | $3,500 |

| Theft or loss of passport (including driver’s license and visa) | $500 | $1,000 |

| Personal Liability Coverage | $1.0 million | $2.5 million |

| Damaged, stolen, or accidental rental cars | without | $2,000 |

| Theft or loss of rental car keys | without | $600 |

* If you are viewing on a smartphone, you can scroll left and right.

* The above amount is the maximum amount to which each compensation applies.

By the way, the medical coverage of Safety Wing, which is popular as overseas nomad insurance, is up to $250,000, so you can see that World Nomads coverage is very generous.

However, if the U.S. is not included in the destination, many overseas nomads decide that they do not need medical coverage of as much as $5 million, and use Safety Wing with reduced premiums.

≫ What Makes Safety Wing Popular Among Digital Nomads?

* If you choose by cost-effectiveness, overseas nomad insurance is the only choice!

Precautions for World Nomads

If you’re thinking of joining World Nomads, here are a few things to keep in mind;

World Nomads Notes

- Higher premiums than other insurance services

- There is a $100 deductible for medical expenses (including dental treatment)

- If you are insured from overseas, there is a 72-hour waiting time.

- People over the age of 65 are not allowed to join World Nomads

Please also note that if you enroll in World Nomads while you are abroad, there is a 72-hour waiting period between the time you apply and the time your insurance is applied.

* You can subscribe to Safety Wing without waiting time.

Please check the above before using World Nomads.

≫ Get an insurance quote with World Nomads

Request World Nomads coverage online when you need it

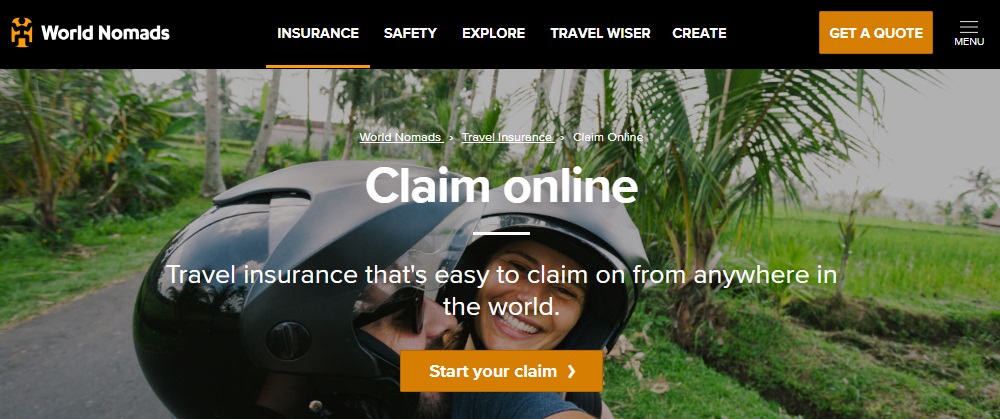

If you encounter an accident or trouble while traveling and need World Nomads coverage, you can claim it 24 hours a day, seven days a week.

Click Claim Online to go to the following page.

Click “Start your claim” to begin the online claim process.

*A login ID is required for the request procedure.

The online billing process is a four-step process;

- Check your insurance policy

- Prepare the required documents

- Get started with online invoicing

- Follow up

All you need to do is prepare documents proving your injuries or accidents and submit them online. All you have to do is email and exchange with the insurance company if necessary and wait for the insurance money to be credited.

①:Check Your Insurance Policy

First, check your travel insurance policy before making an online claim.

Check your World Nomads Certificate of Insurance to make sure your insurance covers what you’re applying for.

②: Prepare the required documents

Please prepare the following documents;

Documents required for online invoicing

- Copy of travel itinerary and booking confirmation

- Receipts for expenses related to the accident

(e.g. medical expenses, lodging expenses, transportation expenses) - Police reports and accident reports

(if applicable) - Medical certificate or document from a medical institution

- Other documents related to the accident

Once you have the above, you can start billing online.

③:Get Started with Online Billing

Access the Claim online page, log in with your World Nomads ID and password, and enter the required information.

After that, upload the documents required for this insurance claim and the procedure is complete.

④:Follow Up

After an online claim, additional review and verification may be required, so check your mailbox regularly and respond quickly to requests from the claims team as needed. This will ensure a smooth process.

Please note that the claim process may take some time. Wait a little patiently for the insurance money to be credited.

Summary: World Nomads is a nomad insurance with full coverage

If you are planning to travel to the United States, we strongly recommend that you purchase overseas nomad insurance with high medical coverage, such as World Nomads.

The monthly fee is a bit high but be prepared for any eventuality.

| Standard | Explore | |

| This does not include the U.S. (if Thailand is specified) | $220.43 | $253.46 |

| Including the U.S | $265.07 | $297.99 |

* The above fee is for the insurance period of 1 month (4 weeks).

* For reference, the price if you select Thailand as your travel destination is listed in the table.

By the way, if you plan to stay in the U.S. for three months, you can get up to $2.5 million in medical coverage for $98.67 per month with an insurance service called Heymondo.

For more information, see What is nomad insurance Heymondo? page.