SafetyWing Nomad Insurance is a reliable option for digital nomads, remote workers, and frequent travelers seeking affordable and flexible health insurance.

With global coverage and adaptable policy features, it offers a practical solution for maintaining health and travel protection without long-term commitments.

The main features are as follows:

Features of SafetyWing

- Monthly Premium: $56.28

- The insurance period can be customized starting from 5 days

(e.g. For a 5-day insurance period, the cost is $10.05) - There is no waiting period when joining from abroad

- 24-hour live chat support

- Coverage for flight delays and lost baggage

- Easy to get a quote and apply for a membership

The pricing structure starts at around $56.28 monthly for travelers under 39, excluding U.S. coverage. Including the U.S. raises the premium but remains cost-effective compared to other international health insurance providers.

Beyond medical protection, SafetyWing also provides coverage for unexpected travel issues, including trip interruptions, lost luggage, and travel delays.

In this article, we’ll introduce the detailed coverage offered by SafetyWing and provide a step-by-step guide on how to purchase (or sign up for) SafetyWing insurance, complete with screenshots.

Nomad Insurance for $56.28/month

* Easy estimate of insurance premiums according to your travel plan!

What is SafetyWing?

SafetyWing is an international insurance provider based in San Francisco, USA, offering health and travel coverage solutions tailored for digital nomads, remote workers, and frequent travelers.

SafetyWing is an international insurance provider based in San Francisco, USA, offering health and travel coverage solutions tailored for digital nomads, remote workers, and frequent travelers.

It focuses on providing affordable, flexible, and comprehensive insurance options that are easy to join and manage.

SafetyWing’s Plans

SafetyWing offers two plans: “Essential” and “Complete.”

Basically, if you are a traveler or digital nomad, the Essential Plan will be fine.

SafetyWing Essential

- Monthly cost starts at $56.28 for travelers aged 10-39 (excluding U.S. coverage)

- Coverage for up to $250,000 for medical emergencies

- Travel coverage for lost luggage, flight delays, and trip interruptions

- Optional add-ons for adventure sports and electronics protection

Designed for individual travelers, this plan covers medical emergencies, travel disruptions, and other unexpected events during trips abroad. It’s best suited for those who frequently travel without needing long-term healthcare.

SafetyWing Complete

- Suitable for businesses with distributed remote teams

- Comprehensive coverage for routine check-ups and preventive care

- Flexible enrollment for employees in multiple countries

This plan is a comprehensive global health insurance service ideal for companies and families. It provides routine healthcare coverage alongside emergency services.

SafetyWing’s Pricing Structure

The insurance premium varies based on the policyholder’s age and whether the destination includes the USA. For details, please refer to the table below.

| Excluding the USA | Including the USA | |

| 10-39 years | $56.28 | $104.44 |

| 40-49 years | $92.40 | $171.92 |

| 50-59 years | $145.04 | $282.80 |

| 60-69 years | $196.84 | $386.12 |

If you are traveling with a child under the age of 10, one child per adult can be covered by insurance for free. However, the number of free children covered per family is limited to two.

Additionally, you can add coverage for adventure sports and theft of electronic devices as optional extras for $10 each.

Additional Coverage Option 1: Adventure Sports

By adding coverage for adventure sports, you will be covered up to $100,000 in case of an accident.

Adventure Sports Covered

American football, Australian football, aviation, bobsleigh, boxing, cave diving, freestyle skiing, hang gliding, high diving, ice hockey, karting, kitesurfing, martial arts, luge, motorcycles, motorized dirt bikes, mountaineering below 6,000 meters, parachuting, parasailing, paragliding, quad biking, rugby, ski/snowboard jumping, ski flying, ski/snowboard acrobatics, skydiving, skeleton, snowmobiling, caving, scuba diving with PADI/NAUI/SSI/BSAC certified instructors, tandem skydiving, white-water rafting, wrestling.

However, professional sports, organized sports, and sports with financial rewards are not covered.

Additional Coverage Option 2: Theft of Electronic Devices

By adding coverage for theft of electronic devices, if items such as laptops are stolen, the insurance will cover up to $1,000 per item, with a maximum annual limit of $3,000 per insurance contract.

Electronic Devices Covered

Laptops, cameras, lenses, smartphones, e-readers, music players, tablets, earphones, headphones, iPads, AirPods, and drones

Note: When claiming theft of electronic devices, you must provide proof that:

- The theft was reported to the police within 24 hours of the incident.

- The electronic device existed before the theft occurred.

≫ Click here for the SafetyWing

SafetyWing’s Coverage Overview

The maximum coverage amount for SafetyWing is $250,000. Within this limit, the following medical services and coverages are provided:

| Insurance Details | Insurance Limit | Specific examples of insurance coverage |

| Medical Insurance | $250,000 | Hospitalization, long-term care, ambulance for hospitalization, MRI diagnosis, long-term care after discharge, prescriptions, etc. |

| Emergency Dental Care | $1,000 | Emergency dental treatment to resolve the onset of acute pain (sudden and unexpected). |

| Emergency Transportation | $100,000 | Emergency transportation costs to a well-equipped hospital |

| Medical repatriation | $5,000 | Emergency repatriation expenses due to medical reasons. |

| Emergency return to your country | $5,000 | Transportation expenses when you have to return to your home country urgently due to the news of a family member’s death. |

| Lost checked baggage on a plane | $3,000 | If you can’t find your luggage after 10 days after the lost baggage occurs (up to $500 per item) |

| Flight delays | $200 | Meals and lodging for delays of more than 12 hours (coverage of $100 per day for up to 2 days) |

| Car Accident | $250,000 | Accidental car accidents caused by the possession of the appropriate license and wearing safety equipment |

| Interruption of travel (return to your country) | $250,000 | Circumstances that force you to return to your home country, such as the death of a family member |

| At the time of death | $20,000 | Transportation costs for transporting the body to your country ($10,000 guarantee for local burial) |

* If you are viewing on a smartphone, you can scroll left and right.

SafetyWing’s popularity among digital nomads lies in its flexibility, affordable pricing, and comprehensive coverage that meets the demands of a mobile lifestyle.

How to make an insurance claim in the event of an emergency

For example, if you have to go to a hospital for treatment due to a cold or injury, you can file a claim within 60 days of the end date of your policy.

Normally, you do not need to contact us in advance, and you can file an insurance claim for the medical expenses you paid at the hospital later.

However, if you need emergency transport to a well-equipped hospital, you should contact the SafetyWing in advance to arrange a hospital.

You can file an insurance claim through the mobile app or a web browser. When making a claim, please have the following documents ready:

Documents required to claim compensation

- Your health certificate

- Invoices for medical expenses that were pair

- Receipts related to compensation

- Your bank account information

To make an insurance claim, please submit the necessary documents from this page and complete the application procedure.

*Login information is required.

SafetyWing Nomad Insurance Reviews

Is SafetyWing a trustworthy insurance provider? After reviewing various SafetyWing insurance reviews online, we’ve compiled the following key insights.

Positive Reviews

✔ Affordable Pricing – Many users highlight that SafetyWing offers some of the most budget-friendly travel insurance options, starting at $56.28 per month.

✔ Flexible Enrollment – Travelers appreciate the ability to purchase or extend coverage while already abroad, unlike traditional insurance plans that require enrollment before departure.

✔ Global Coverage – SafetyWing provides worldwide coverage, including emergency medical care, travel disruptions, and optional add-ons like adventure sports and electronics theft protection.

✔ Easy Claims Process – Some users report smooth reimbursement experiences, especially for minor medical expenses and travel-related claims.

✔ 24/7 Support – The availability of live chat and customer support is a key advantage for nomads who may need assistance in different time zones.

SafetyWing receives praise for its affordability, flexibility, and ease of use, making it a preferred choice for digital nomads and frequent travelers.

Negative Reviews

✘ Limited Coverage for Chronic Conditions – SafetyWing does not cover treatment for pre-existing or chronic illnesses, which some users find restrictive.

✘ High Deductible – The $250 deductible per claim can be a drawback for those who need frequent medical care, as small expenses might not be reimbursed.

✘ Delays in Claims Processing – Some users report slow claim approvals and challenges in receiving payouts, particularly for more complex cases.

✘ U.S. Coverage Limitations – Even with U.S. coverage, users must pay a $100 copay for emergency room visits and $50 for urgent care, which adds to out-of-pocket costs.

✘ Electronics Theft Claims Require Strict Proof – To claim compensation for stolen electronics, users must provide a police report within 24 hours and proof of prior ownership, which can be difficult in some cases.

While SafetyWing is widely used, some travelers have expressed concerns about certain aspects of the service.

Our Insights on SafetyWing Insurance Reviews

SafetyWing Nomad Insurance is a great option for travelers looking for affordable, flexible, and globally available coverage.

It works well for those who need emergency medical care and travel protection but may not be ideal for individuals requiring ongoing healthcare or extensive claims support.

Best For:

✔ Digital nomads, remote workers, and frequent travelers.

✔ Those who want flexible, month-to-month coverage.

✔ Travelers who need emergency medical and travel protection.

Not Ideal For:

✘ Individuals with chronic illnesses requiring regular treatment.

✘ Those who prefer low deductibles for minor medical expenses.

✘ Travelers who need immediate reimbursement for claims.

Overall, SafetyWing remains a popular choice due to its competitive pricing and broad coverage, but travelers should carefully review the policy details to ensure it meets their specific needs.

SafetyWing vs Heymondo, World Nomads, Genki

When comparing travel insurance providers, SafetyWing stands out for its affordability and balanced coverage.

Here’s how it compares to Heymondo, World Nomads, and Genki.

| Feature | SafetyWing | World Nomads | Heymondo | Genki |

| Monthly Premium | Including U.S.: $104.44 Excluding U.S.: $56.28 | Including U.S.: $265.07 Excluding U.S.: $220.43 | Including U.S.: $133.36 Excluding U.S.: $113.05 | €48.30 (under 30, incl. U.S.) |

| Minimum Enrollment Period | 5 days | 1 day | 1 day | 1 month |

| Medical Insurance | $250,000 | $5 million+ | $5 million+ | Unlimited |

| Emergency Dental Care | $1,000 | $300 | $300 | €500 for pain relief, €1,000 for accident-related care |

| Flight delays | $200 | $500 | $450 | Not covered |

| Baggage coverage | Not covered | $2,500 | $1,700 | Not covered |

| Waiting Period | None (Immediate coverage available) | 72 hours | 72 hours | 14 days (if joining abroad) |

* If you are viewing on a smartphone, you can scroll left and right.

Pricing & Flexibility

- SafetyWing: Most affordable at $56.28/month, with 5-day minimum enrollment for flexibility.

- Heymondo: Starts at $113.05/month, nearly double the price of SafetyWing.

- World Nomads: The most expensive at $220.43/month, but offers extensive benefits.

- Genki: At €48.30/month, it’s cost-effective but lacks travel-related protections.

Medical Coverage

- SafetyWing: Covers up to $250,000 per policy period.

- Heymondo & World Nomads: Offer $5 million+, suitable for those seeking higher medical limits.

- Genki: Provides unlimited medical coverage, but excludes travel-related benefits.

Travel Protections

- SafetyWing: Covers lost baggage ($3,000), flight delays ($200 for 12+ hours), and emergency transport ($100,000).

- Heymondo & World Nomads: Offer higher baggage and trip protection but at a premium price.

- Genki: Not cover

≫ The Best Nomad Insurance; We highly recommend Safety Wing [$56/month]

Important Considerations When Joining SafetyWings

Before choosing SafetyWing for your travel insurance, it’s essential to be aware of its limitations and key factors that may impact your coverage.

While SafetyWing is a popular and cost-effective choice for digital nomads, understanding its exclusions and policy conditions will help you determine if it’s the right fit for your needs.

Key Precautions for SafetyWing:

- Limited Chronic Illness Coverage: SafetyWing does not cover treatment for chronic conditions such as cancer or long-term pre-existing conditions.

- U.S. Co-Pay Requirement: Even with U.S. coverage, you must pay $100 per emergency room visit and $50 per urgent care visit.

- No Coverage for Professional Sports or High-Risk Activities: While optional adventure sports coverage is available, professional and organized sports are not covered.

- Restrictions on Theft Claims: Electronic device theft is covered only if reported to the police within 24 hours and with proof of ownership.

- Mandatory Pre-Authorization for Hospitalization: If you require inpatient care, you must notify SafetyWing before discharge to ensure coverage.

- Age Limitations: SafetyWing is unavailable for individuals over 70 years old.

- Claims Deadline: All claims must be submitted within 60 days of the policy’s termination.

Considering these factors, evaluate whether SafetyWing aligns with your insurance needs or if additional policies are necessary to cover potential gaps, such as lost baggage, trip cancellations, or personal liability.

How to purchase SafetyWing insurance [with screenshot]

I will introduce how to purchase (contract) SafetyWing insurance with screenshots.

When you click on the official website of SafetyWing, the following screen will be displayed.

Buy “Insurance for nomads” on the left. Click on the “Go to Nomad Insurance” button below.

Next, click “Sign me up” under the notation of the monthly fee of $ 56.28.

* The insurance period can be customized after signing up.

Please fill out the form below with your email address and password to log in. It is also possible to log in with an account such as Google yes.

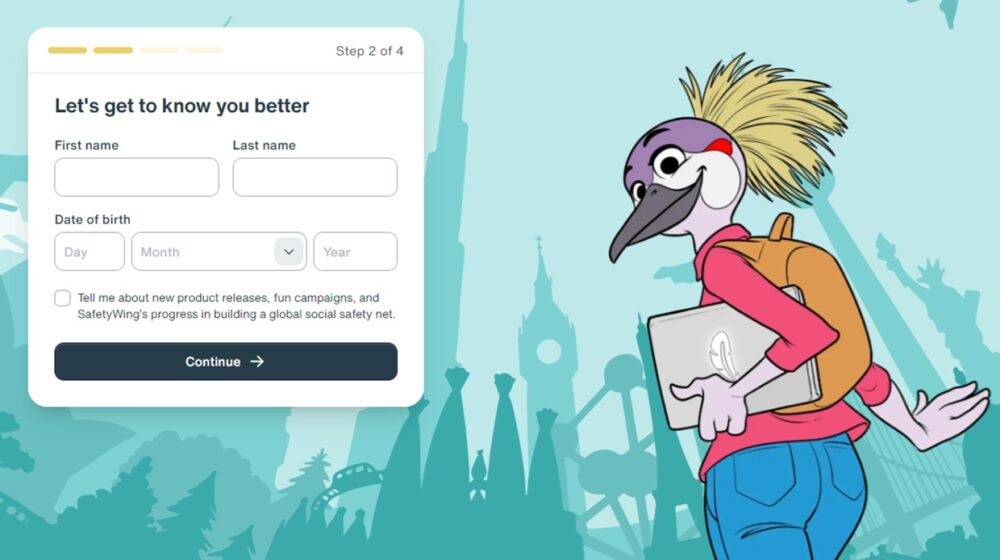

Then, follow the form below to register your full name and date of birth.

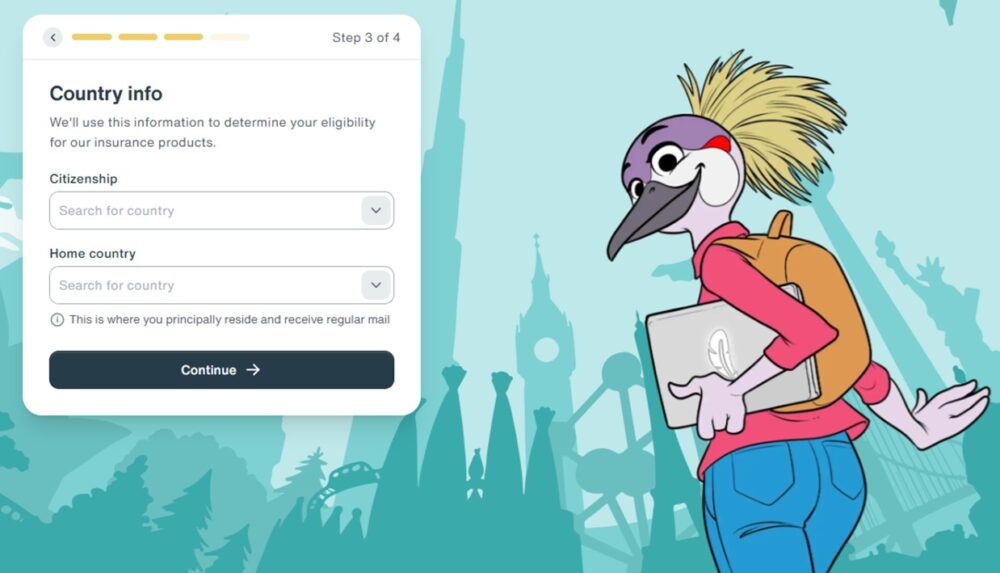

Subsequently, select the country and nationality of your citizenship.

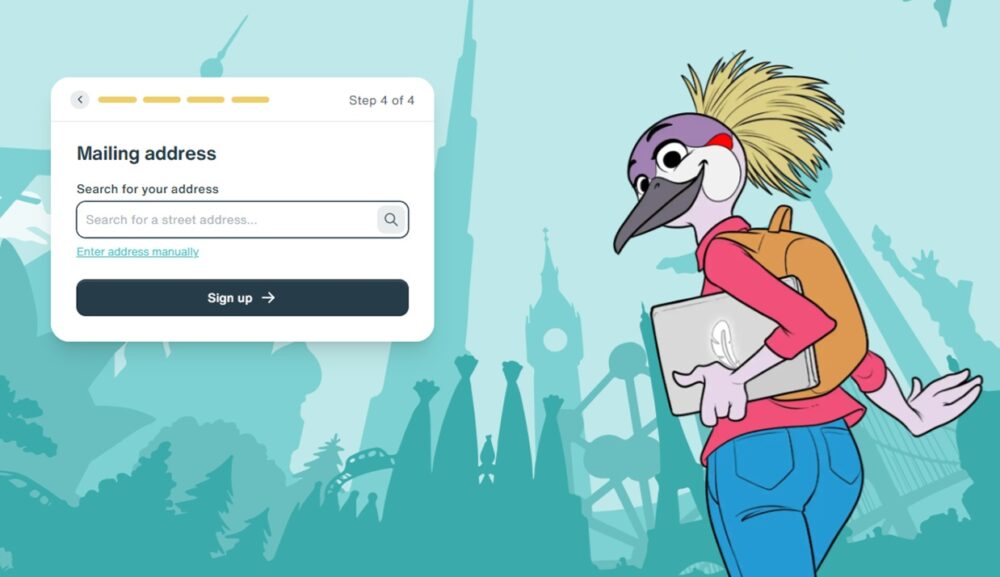

Next, register your address. Enter your zip code in the field below, or enter your address manually.

If you can register your address, you have signed up.

Subsequently, select your insurance plan.

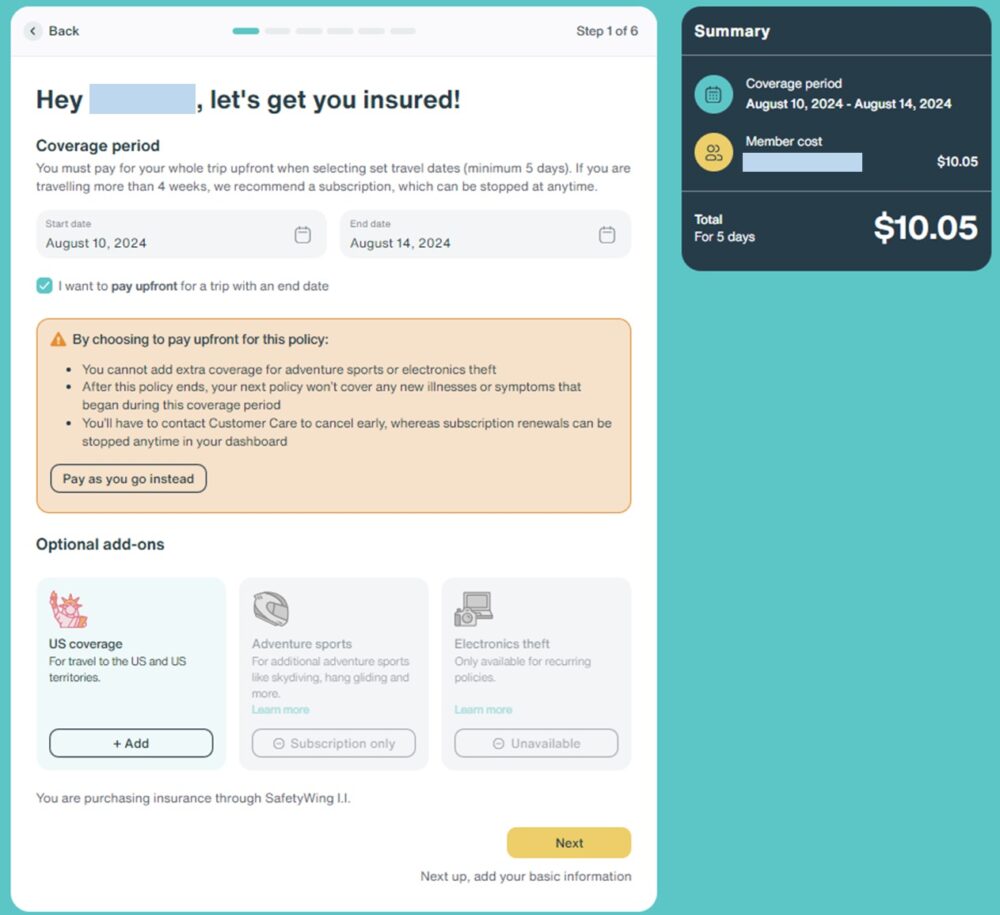

If you want to customize the policy period according to your travel Thailand instead of a monthly policy of $56.28 per month, you can check “I want to pay upfront for a trip with an end date” and you will see a column to select the insurance start and end dates as shown below.

As shown in the screenshot above, the insurance fee according to the specified insurance period is displayed on the right side. After confirming the insurance fee, click “Next”.

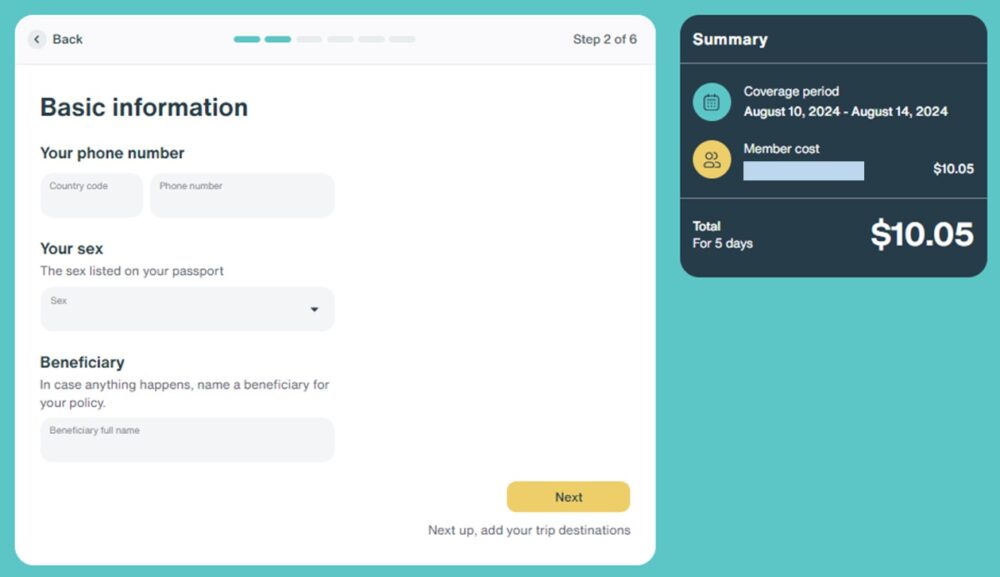

Follow the form below to provide your phone number, gender, and the name of the person who will receive the insurance on your behalf in the unlikely event of an accident such as death.

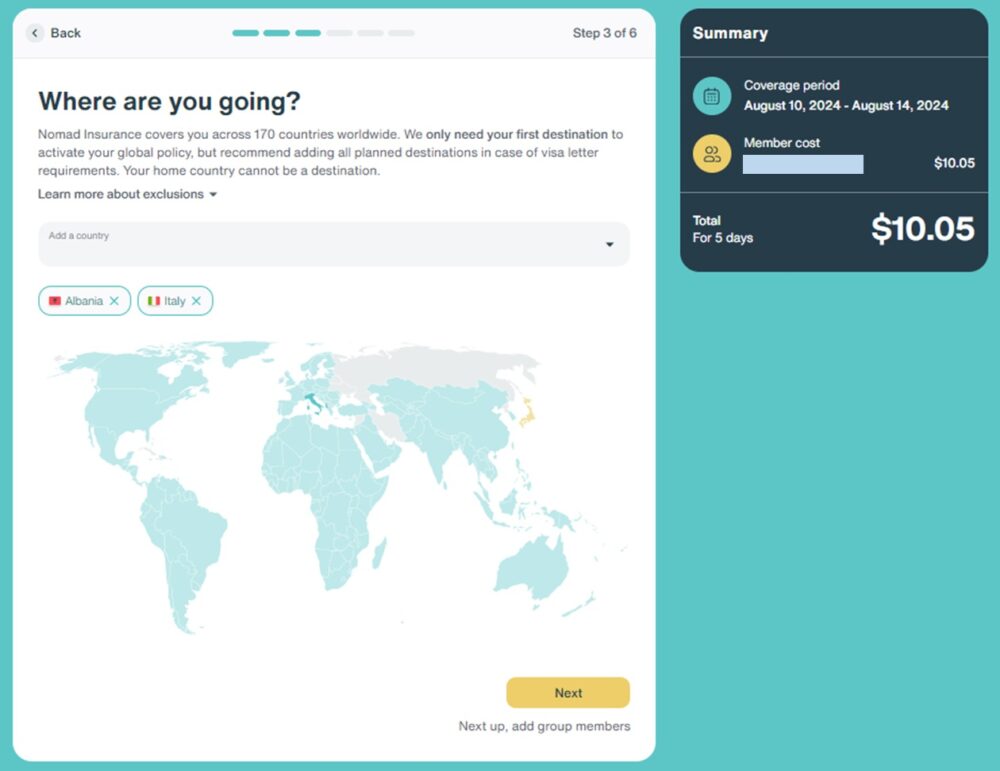

Next, select the destination (country) to which you want to apply the insurance. If you are traveling across more than one country, please select all countries you are staying in or transiting through.

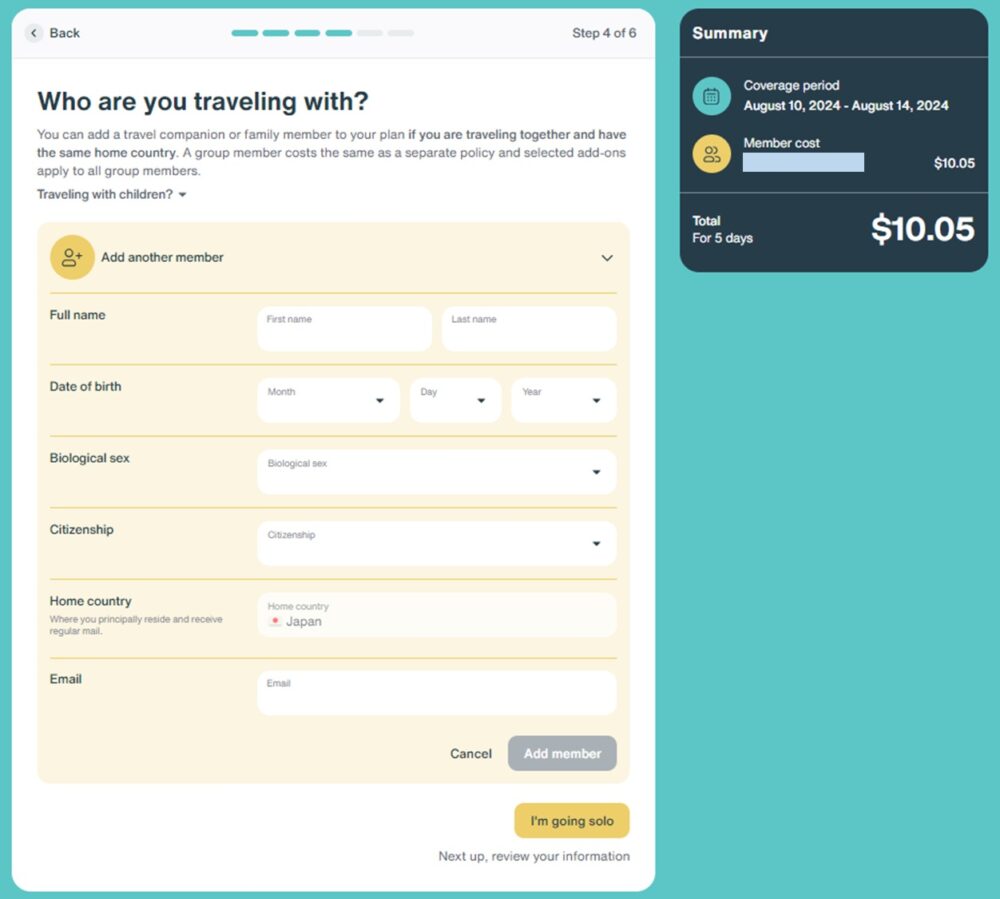

Then, if you have a companion, add them by following the form below. If you are traveling unaccompanied (solo), please tap “I’m going solo”.

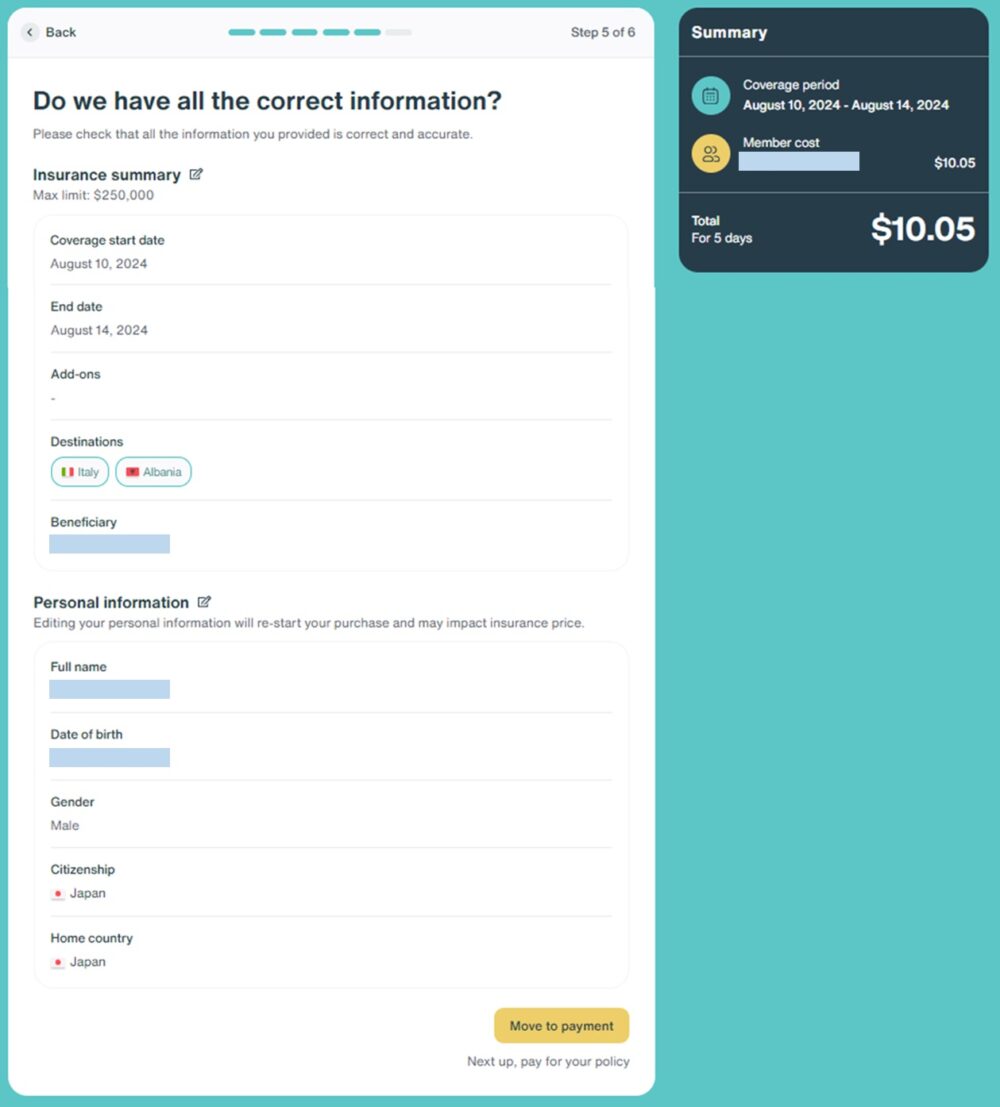

Please check the application details below and tap “Move to payment” if there are no problems.

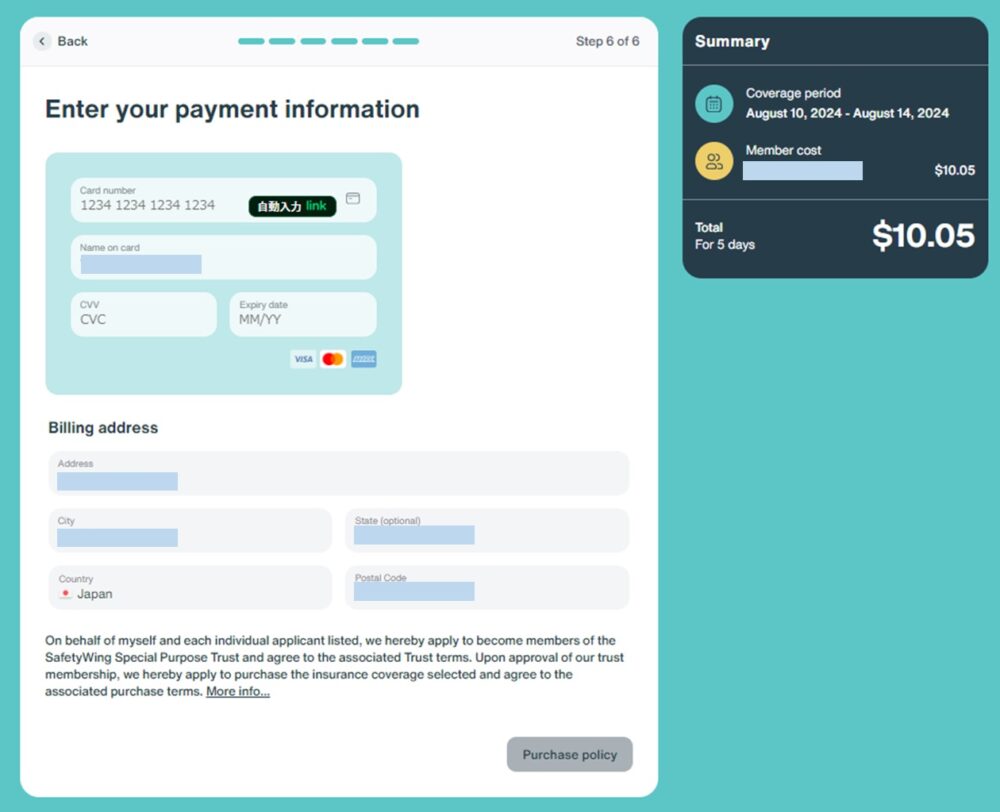

Finally, enter your credit card and billing information.

This completes the process of purchasing SafetyWing insurance.

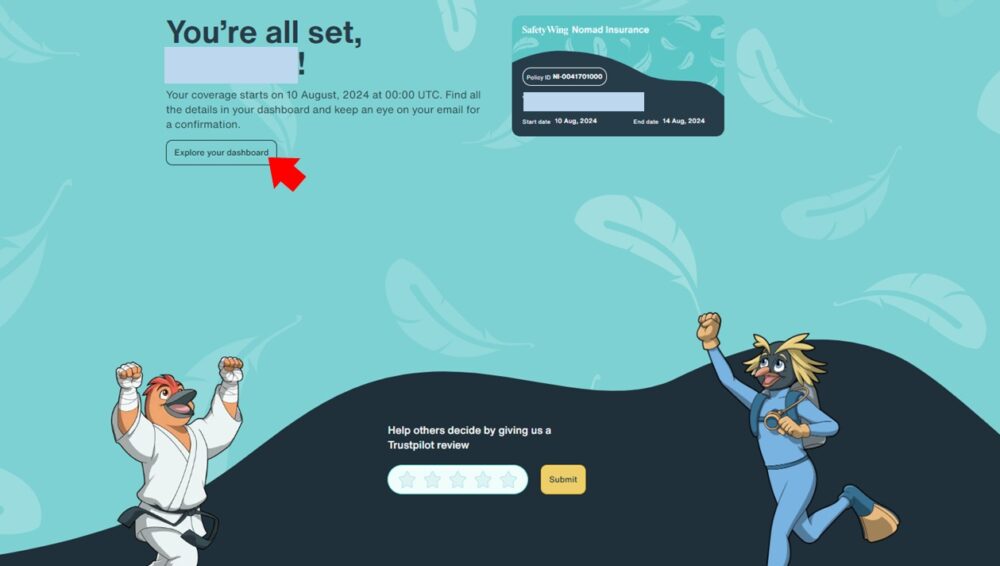

Let’s go to the “Dashboard” and check the insurance details that you have purchased.

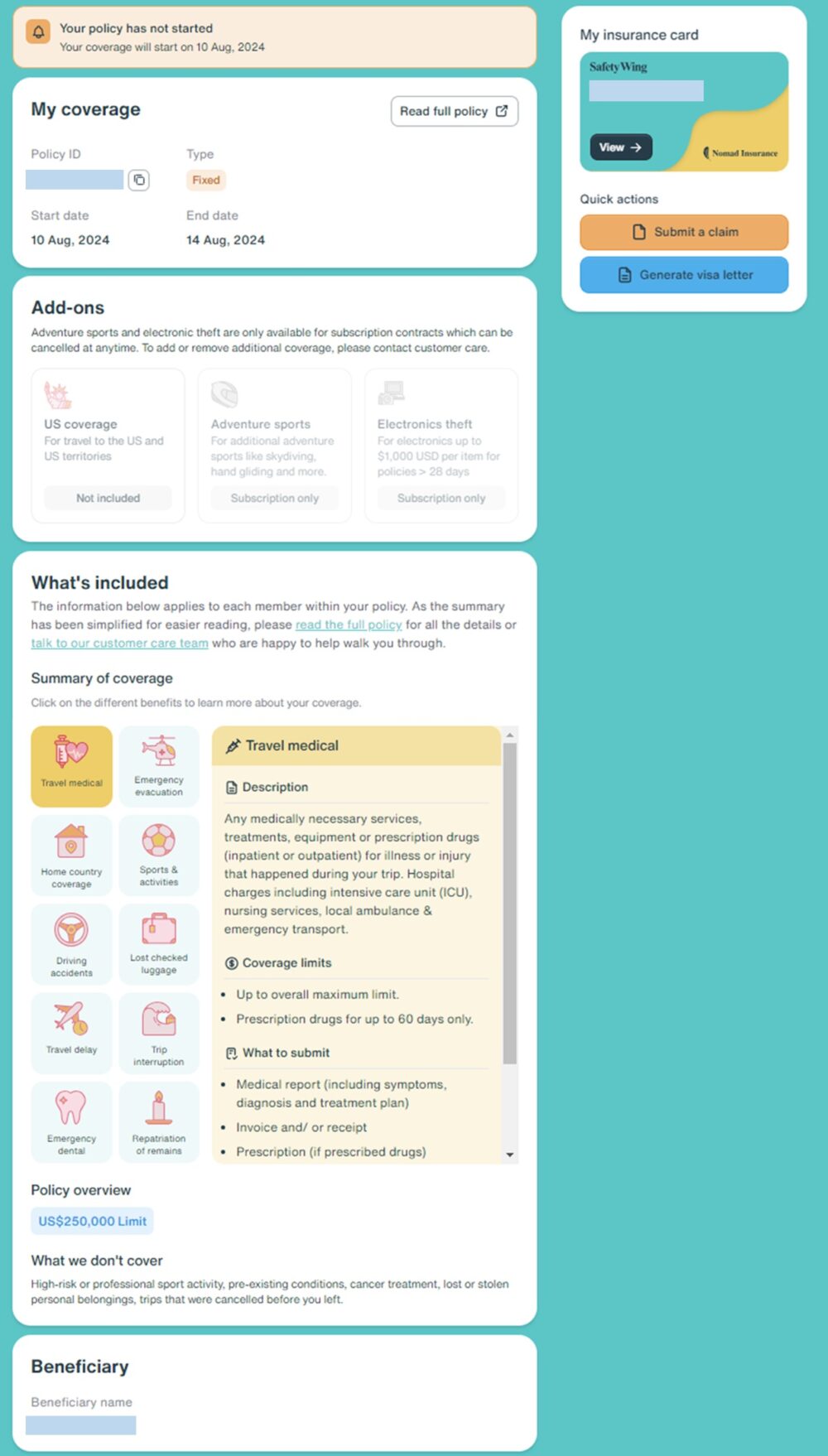

You can check the details of the purchased policy on the dashboard as follows:

You can also check the coverage details on the above page, so you can rest assured!

≫ Click here for the SafetyWing

Conclusion: SafetyWing is cost-effective and has a lot of coverage

SafetyWing is a top choice for digital nomads and long-term travelers due to its affordable pricing and comprehensive coverage.

Starting at just $56.28 per month (excluding U.S. coverage), it offers medical care, lost baggage, flight delays, and trip interruptions, benefits many competitors lack.

The monthly fee (4 weeks fee) for SafetyWing (Nomad Insurance) is as follows.

| Excluding the USA | Including the USA | |

| 10-39 years | $56.28 | $104.44 |

| 40-49 years | $92.40 | $171.92 |

| 50-59 years | $145.04 | $282.80 |

| 60-69 years | $196.84 | $386.12 |

For the above monthly fee, you can get up to $250,000 in medical insurance.

Insurance services are a throwaway. If you can live abroad without getting injured or sick or involved in an accident, you don’t need insurance.

However, it is important to be prepared in case of an emergency.

If you’re looking for affordable and comprehensive coverage, SafetyWing remains one of the best options for global travelers.

Nomad Insurance for $56.28/month

* Easy estimate of insurance premiums according to your travel plan!

![The Best Nomad Insurance; We recommend SafetyWing [$56.28/month]](https://ararablog.com/wp-content/uploads/2024/08/Featured-Image01-640x360.jpg)

![The Best Nomad Insurance; We recommend SafetyWing [$56.28/month]](https://ararablog.com/wp-content/uploads/2024/08/Featured-Image01-320x180.jpg)