Genki Insurance is a trusted solution for those living or traveling abroad, including digital nomads and expats. Known for its long-term health focus, it provides adaptable coverage options tailored to meet diverse global healthcare needs.

One standout feature is its strong support for healthcare services in countries with notoriously high medical expenses, such as the United States.

For example, opting for the Genki Explorer plan over three months is estimated at $300 ($100 per month), ensuring peace of mind with robust emergency care and worldwide medical coverage.

Key Features of Genki Insurance

- Global Coverage Flexibility

→ Genki Explorer Plan: €48.30 per month (Excluding the U.S. and Canada)

→ Genki Native Plan: €180+ per month

- Seamless Enrollment: You can enroll at any time—before departure, after leaving your home country, or even while traveling.

- 24/7 Assistance: Genki provides round-the-clock customer support to address health emergencies or policy concerns.

- Comprehensive Health Protection

→ Genki Explorer Plan: Covers emergency medical expenses, including hospitalization, accidents, and medical transport.

→ Genki Native Premium: Offers additional coverage for preventive care, dental, vision, maternity, and mental health services.

- No Travel-Specific Coverage: Genki focuses exclusively on healthcare and does not cover travel disruptions or baggage loss.

If you’re traveling to destinations without high healthcare costs, SafetyWing at $56.28 per month with $250,000 medical coverage might be a better budget-friendly alternative.

* Insurance schedule can be adjusted from as little as 5 days!

If long-term healthcare is your priority, especially for stays in high-risk regions like the U.S., or if you want a strong healthcare partner as a digital nomad, Genki Insurance stands out as a solid choice.

On this page, I will explain in detail the price plans and coverage contents of Genki, which is a must-see for travelers to the U.S., so please refer to it!

What is Genki?

Genki Insurance is a global health insurance provider tailored for digital nomads, expats, and frequent travelers.

Genki Insurance is a global health insurance provider tailored for digital nomads, expats, and frequent travelers.

It offers comprehensive international coverage, ensuring travelers access quality healthcare worldwide.

Unlike traditional travel insurance, Genki focuses on long-term health protection, making it ideal for those who spend extended periods abroad.

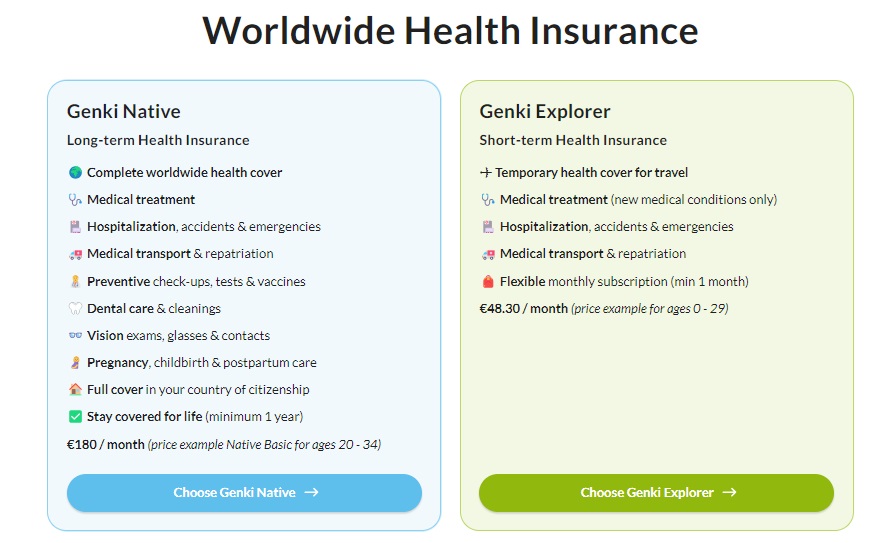

Two Genki Insurance Plans

Genki Insurance provides two plans: Genki Native for expatriates and Genki Explorer for long-term travelers.

Genki Native

*Best for Expats & Residents

- Comprehensive Health Coverage: Ideal for individuals settling abroad, offering preventive care, chronic condition management, and maternity coverage.

- Long-Term Protection: Tailored for permanent or semi-permanent residents needing consistent healthcare access.

- Chronic Care Support: Excellent for managing ongoing health conditions.

Genki Explorer

*Best for Digital Nomads & Frequent Travelers

- Global Flexibility: Perfect for travelers with worldwide healthcare access to frequently changing countries.

- Emergency Medical Coverage: Covers urgent medical treatments and hospitalizations during travels.

- Short-Term Commitment: No need for long-term contracts, offering flexibility during travel periods.

The “Genki Explorer” plan is best suited for digital nomads living abroad.

Below is a comparison of the key differences between the plans.

By the way, Genki’s insurance plan does not have an option to include or not include the U.S., it covers the whole world. However, the monthly fee depends on the age of the subscriber.

Genki Insurance fees

Genki’s monthly fee varies depending on your age and the coverage options you select. The table below provides an overview of how fees are structured:

| 20~29 years old | 30~39 years old | 40∼49 years old | 50∼59 years old | 60~69 years old | |

| ✅There are limits on coverage in Canada and the U.S. ✅There is a €50 deduction per case | €48.30 | €57.30 | €72.30 | €105 | €168.30 |

| ✅There are limits on coverage in Canada and the U.S. | €96.30 | €105.30 | €123.30 | €162.30 | €240.30 |

| ✅There is a €50 deduction per case | €96.30 | €114.30 | €156.30 | €231.30 | €378.30 |

| unlimitedness | €153.30 | €174.30 | €225.30 | €315.30 | €492.30 |

* If you are viewing on a smartphone, you can scroll left and right.

If you plan to stay abroad for 3 months or longer, opting for Long Stay Travel Insurance can help reduce your monthly premiums.

What are the coverage limits in Canada and the U.S.?

You can save money on your monthly premiums by limiting your stay in Canada and the U.S. to a total of 42 days in six months.

* If you do not plan to stay in Canada and the United States, or if you will stay for less than 42 days in six months, add this option!

What is a €50 deduction per case?

At the time of insurance application, you will pay 50 euros per case. For example, in the case of a medical expense of 1,000 euros, 50 euros will be paid as a co-payment and the remaining 950 euros will be covered.

On the other hand, if your travel plans don’t include the U.S. and you don’t require extensive medical coverage, SafetyWing might be a cost-effective alternative. It costs just $56.28 per month and offers up to $250,000 in medical coverage.

» The Best Nomad Insurance; We highly recommend SafetyWing [$56/month]

Genki Insurance Coverage Overview

Here’s a closer look at the insurance coverage.

The table below provides a detailed breakdown of the Travel Insurance benefits:

| Insurance Details | Insurance Limit |

| Treatment, including inpatient and outpatient treatment | unlimitedness |

| Medicines, Pharmaceuticals, Bandages | unlimitedness |

| Treatments to reduce tooth pain (including simple fillings and repairs to repair denture function) | €500 |

| Dental care required as a result of an accident | €1,000 |

| Initial response to outpatient psychomedical care | €1,500 |

| Inpatient emergency treatment for psychiatric and psychological disorders of the first occurrence | €20,000 |

| Transportation costs to the next hospital by an authorized emergency medical service | unlimitedness |

| Medically effective and reasonable evacuation for the transfer of the insured person to his place of residence | unlimitedness |

| Repatriation of the body of the insured person upon death | unlimitedness |

| Deductible applicable only during your stay in the United States: For emergency room treatment, exemption in case of medical necessity or subsequent inpatient treatment | unlimitedness |

| Insurance Extension in the Case of Extended Stay Abroad for Medical Reasons | 90 days |

* If you are viewing on a smartphone, you can scroll left and right.

Even if you’re not planning to visit Canada or the United States, the coverage remains highly affordable at just €48.30 per month.

Keep in mind that Genki is a nomad insurance provider focused solely on medical coverage, meaning it doesn’t include protection for personal belongings, flight delays, or financial losses.

Genki Insurance Reviews

Is Genki Insurance a trustworthy provider? After reviewing various Heymondo insurance reviews online, we’ve compiled the following insights.

Positive Reviews

Many travelers appreciate Genki for its:

- Unlimited Medical Coverage: Users value the extensive medical benefits, including unlimited coverage for inpatient and outpatient treatments even in high-cost regions like the U.S.

- Affordable for Younger Travelers: The €48.30 monthly premium for those under 30 is seen as cost-effective, particularly given the global coverage.

- Flexible Subscription: The month-to-month payment structure makes it convenient for digital nomads who may not need long-term coverage.

Negative Reviews

Despite its advantages, Genki has received some criticisms:

- No Coverage for Travel Issues: Users noted the lack of protection for flight delays, lost baggage, or stolen personal belongings.

- Limited U.S. and Canada Coverage Option: The 42-day restriction for stays in these regions without additional fees may be inconvenient for long-term travelers.

- Waiting Period: A 14-day waiting time for insurance to apply when enrolling from overseas has been a point of frustration for some users.

Genki vs SafetyWing

SafetyWing is one of the most popular travel insurance choices for international travelers.

Here’s a comparison outlining the key differences between Genki and SafetyWing.

| Feature | Genki | SafetyWing |

| Monthly Premium | €48.30 (under 30, incl. U.S.) | – Including U.S.: $104.44 – Excluding U.S.: $56.28 |

| Minimum Enrollment Period | 1 month | 5 day |

| Medical Insurance | Unlimited | $250,000 |

| Emergency Dental Care | €500 for pain relief, €1,000 for accident-related care | $1,000 |

| Flight delays | Not covered | $200 |

| Baggage coverage | Not covered | Not covered |

| Waiting Period | 14 days (if joining abroad | None (Immediate coverage available) |

* If you are viewing on a smartphone, you can scroll left and right.

» SafetyWing Nomad Insurance Reviews: Pricing, Coverage and Benefits

Genki vs Heymondo

Heymondo is a leading travel insurance option for international travelers.

Here’s a comparison highlighting the key differences between Genki and Heymondo.

| Feature | Genki | Heymondo |

| Monthly Premium | €48.30 (under 30, incl. U.S.) | – Including U.S.: $133.36 – Excluding U.S.: $113.05 |

| Minimum Enrollment Period | 1 month | 1 day |

| Medical Insurance | Unlimited | $5 million+ |

| Emergency Dental Care | €500 for pain relief, €1,000 for accident-related care | $300 |

| Flight delays | Not covered | $450 |

| Baggage coverage | Not covered | $1,700 |

| Waiting Period | 14 days (if joining abroad | 72 hours |

* If you are viewing on a smartphone, you can scroll left and right.

» Heymondo Insurance Reviews: Comprehensive Travel Coverage Explained

Which Insurance Should You Choose?

Choosing the right insurance depends on your travel plans and priorities.

If medical coverage is your primary concern, particularly for destinations like the U.S., Genki stands out by offering unlimited medical coverage for inpatient and outpatient treatments. This makes it a reliable choice for digital nomads and long-term travelers who prioritize health security.

However, for travelers seeking coverage for baggage loss, flight delays, or trip cancellations, Genki may not be the most comprehensive option as it focuses solely on medical protection.

For a more balanced insurance plan that includes both medical and non-medical coverage, alternatives like Heymondo or SafetyWing may better fit your travel needs.

Important Considerations: Not covered by Genki Insurance

Before choosing Genki for your travel insurance, keep the following limitations in mind.

Precautions for Genki Insurance

- No coverage for flight delays or cancellations

- Lost or stolen belongings are not compensated

- No baggage protection or personal money loss coverage

- A 14-day waiting period applies if you enroll from overseas

- The subscription automatically renews monthly until canceled

After reviewing these factors, consider whether Genki aligns with your medical insurance needs and whether additional policies are necessary to cover non-medical risks.

Conclusion: Genki is a insurance specializing in medical insurance

Genki Insurance is an excellent choice for digital nomads and long-term travelers who prioritize unlimited medical coverage, even in high-cost regions like the United States.

Its straightforward monthly subscription and reasonable fees make it highly appealing for younger travelers, particularly those under 30 (€48.30 per month).

However, Genki’s focus on medical insurance only means it lacks coverage for essential travel concerns such as flight delays, lost baggage, or theft of belongings.

For travelers seeking a well-rounded insurance package, this could be a limitation.

| SafetyWing | Heymondo | World Nomads | Genki | |

| Insurance (4 weeks) | ・$56.28 (not including the US) ・$104.44 (including the US) | ・$113.05 (not including the US) ・$130.16 (including the US) | ・$220.43 (not including the US) ・$265.07 (including US) | ・€48.3 (20s) ・€57.3 euros (30s) ・€72.3 euros (40s) |

| Medical Compensation | $250,000 | $5,000,000 | $5,000,000 | Unlimitedness |

| Emergency Transportation (Medical Return/Death Transport) | $20,000 | $500,000 | $500,000 | Unlimitedness |

| Dental treatment | $1,000 | $300 | $300 | $500 |

| Flight delays | $200 | $450 | $500 | Without |

| Damaged/stolen/lost personal belongings | Without | $1,700 | $2,500 | Without |

| Standby time | 0 hours | 72 hours | 72 hours | 14 days |

* If you are viewing on a smartphone, you can scroll left and right.

If your destination doesn’t include the United States, we highly recommend SafetyWing ($56/month) for its comprehensive travel coverage, including both medical and non-medical incidents.

“SafetyWing offers an ideal balance of coverage and affordability for travelers outside the U.S., with a medical cap of $250,000.”

Bottom line: If you require extensive non-medical benefits along with healthcare coverage, SafetyWing is a versatile and affordable alternative for your travel insurance needs.